Keeping Competitors Of Gaurd

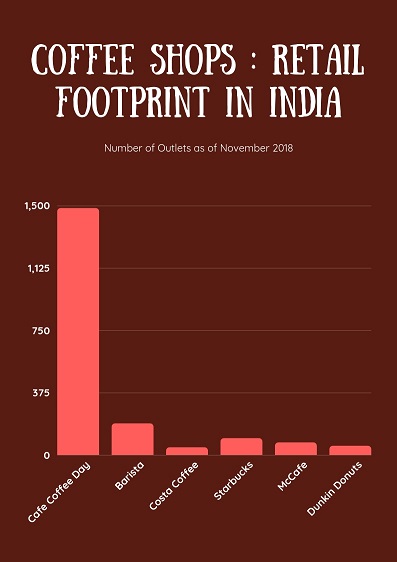

In the present situation, CCD has successfully dwarfed all its competitors in India. CCD has more outlets compared to all of its competitors combined. The outlets of CCD are spread across 240 cities in India. CCD has 1,480 outlets as of November 2018. At the second spot was Barista, with 190 outlets, a distant second. Behemoth of the global coffee industry, Starbucks has just 101 outlets in India, 50% of which (49) are in Maharashtra. CCD Plans to add 700+ outlets across India by next 7-8 years.