Despite PM Modi's push for green energy, fossil fuels are not dying out anytime soon.

On 25 November, the Centre announced its decision to open 55,649 new petrol pumps in the country. There are 59,595 petrol pumps operating in the country. Over the next three years, the country's three state-owned oil marketing companies (OMCs) plan to nearly double the number of fuel pumps they operate collectively.

While this move is aimed to pull thousands of crores of investment in the fuel retailing business and create more than 2 million jobs, it perfectly sets the stage for the BJP government, which is ramping up for the 2019 general elections.

India's obliged in Paris Climate Change to reduce its carbon emission by 33–35% from its 2005 levels by 2030. The current move will push India's plan to shift to renewable energy sources to the backseat.

• • • •

The Current Scenario

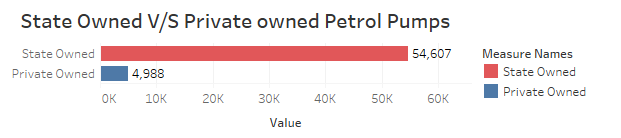

The majority of the petrol pumps in India are currently operated by state-owned oil marketing companies (OMCs) like Indian Oil Corporation Ltd. (IOCL), Bharat Petroleum (BP), Hindustan Petroleum (HP). IOCL accounts for the maximum market share with 44%, while private companies mainly Reliance and Essar only account for 9.6% of the petrol pumps under operation. Since diesel was sold at a subsidised price in India till 2014, the government compensated state-owned oil firms. The private fuel marketers received no such subsidy, which slowly edged them out of the market. But since 2010 petrol was de-regularised and then in 2014, diesel was de-regularised, it opened the gates for private players as well.

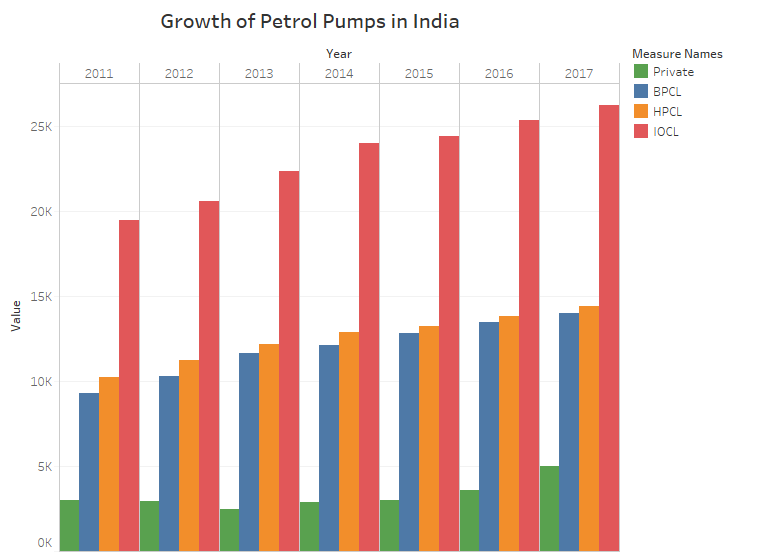

As the above map graph shows, there has been a steady increase in the number of petrol pumps in India over the last 7 years. The growth of the Government owned IOCL is the highest while the number of petrol pumps of the other two OMCs also grew at a steady pace. Private players like Reliance and Essar show a very slow growth in the number of petrol pumps in the last 7 years with the number of petrol pumps being almost stagnant from 2014–16.

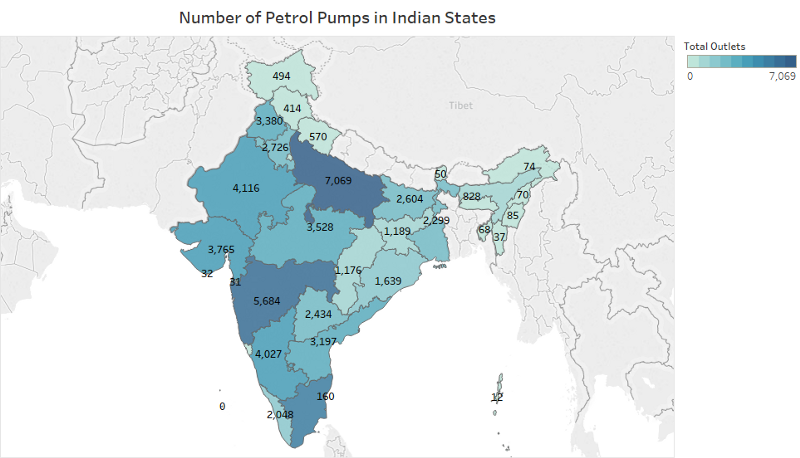

The dashboard contains distribution of Petrol Pumps for different Companies for each state.• • • •

The map below shows the number of Petrol Pumps in each state. States, where a sizeable number of retail outlets has been offered, include Bihar (2,951), Tamil Nadu (2,951), Andhra Pradesh (2,815), Odisha (2,636), West Bengal (2,242), Jharkhand (1,905), Kerala (1,730), and Assam (1,026).

• • • •

While the country's three state-owned oil marketing companies (OMCs) plan to nearly double the number of fuel pumps over the next three years, the main problem is either unnoticed or is being unnoticed.

According to Firstpost, 80 percent of the total petrol retail outlets are at a loss due to low sales.

Currently, all petrol pumps in India operate under three different categories- company-owned and company operated (COCO), company-owned and dealer operated (CODO) and dealer-owned and dealer operated (DODO).

The worst affected are the DODOs. This model requires the dealer to bring their own land (800 m sq in rural area and 1500 m sq on highways), security deposit of around 2 lakhs and the initial investment which ranges from 20 lakh to 70 lakh rupees.

Many retailers want to exit the business but they cannot because, according to current laws, the OMCs are not liable to return the land on which the petrol pump is setup.

On national and express highways, cluster of many 5–6 petrol pumps can be seen within a 1-2 KM stretch. These retailers hardly get any business and there is no way for them to exit.

Concerning the new petrol pumps announcement, the AIDPA called for the OMCs to publicize their economic viability report, specify the returns on investments especially with the daily price change mechanism now in force, and provide an exit route to ensure it is not "being deceitful to the new businessmen", as reported by Firstpost.

• • • •

The Road Ahead

Centre has also decided to ease up petrol pump regulations before the 2019 general elections .

"When the government is introducing alternatives fuels like electricity, biofuels, CNG, on one side and doubling the number of petrol pumps, the decision smacks of ignorance or a compromise of the existing business," Ali Daruwalla, national spokesperson of All India Petrol Dealers Association (AIPDA) told IANS. Averting the decision to open new petrol pumps will help the retailers to stay in the game for a longer time and avoid the problem of excess supply.

The availability of fossil fuels is becoming scarce. The entire world is moving towards renewable energy. As per the Paris Climate Change agreement, India is obliged to reduce its carbon emission by 33–35% from its 2005 levels by 2030. To achieve this, India has to start investing more in renewable, fossil-free sources of energy rather than increasing investment in the fossil fuel sector.

Instead of opening new petrol pumps, the focus should be on opening charging stations for electric vehicles. Electric vehicles are the future and countries like the US and China are investing more in building the required infrastructure to sustain the electric ecosystem. Incentives should be provided to private sector players to supply renewable sources of energy. India should also start investing more in renewable sources to prevent future fossil fuel crackdowns in the future and promote sustainable development.

• • • •